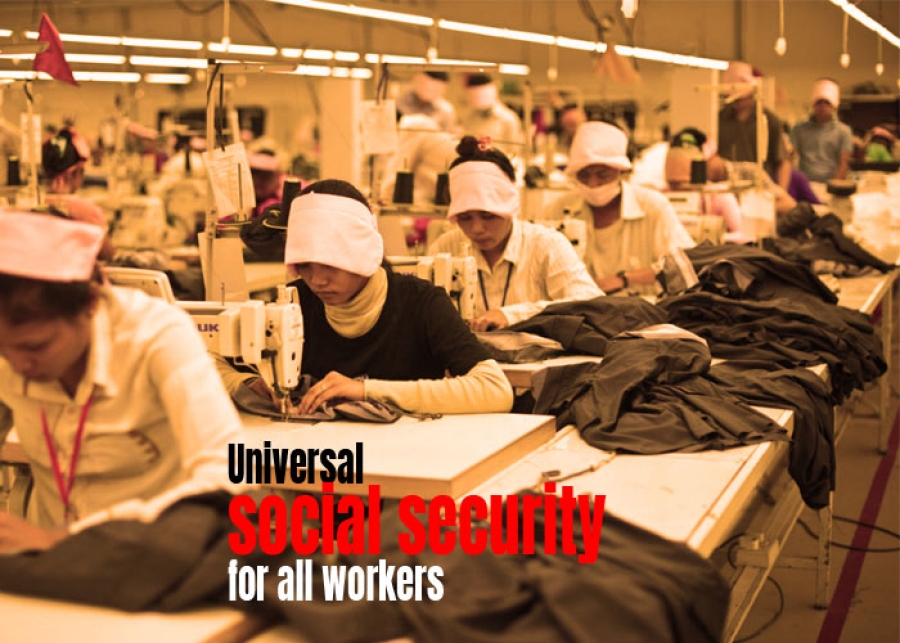

The trade unions are demanding universal social security for all workers.

Today a very small section of workers, mainly in the organised sector only are covered by social security benefits like provident fund, ESI, medical benefits, maternity benefit, accident compensation, gratuity, pension etc. Given the tardy enforcement mechanism, encouraged by the governments themselves, even fifty percent of the workers in the organised sector, particularly the contract workers, are also deprived of their legitimate social security benefits.

Despite contributing to over 60% of the country’s GDP, the unorganised sector workers do not get any social security benefits. Some segments of the unorganised sector workers like the beedi workers, construction workers, mine workers, cine workers etc are of course statutorily entitled to some social security benefits. But not even 30% of these workers are covered in practice because of the total absence of effective enforcement machinery for these schemes, either at the central level or in the states.

Ensuring ‘ease of doing business’ for the employers has become a priority under the neoliberal policies. For the present Modi led BJP government, this appears to be the determining factor of government policy. Enforcement of labour laws is the first casualty of such a policy. During the last one and a half decade, hardly 25% of the fund collected through cess for the construction workers’ welfare scheme was spent on providing benefits to the construction workers. The situation related to beedi workers and others is not much different.

The BJP led government’s high decibel advertisements proclaim that its Code on Social Security is going to cover the entire workforce including the rickshaw pullers and domestic workers.

But cover with what? There is no answer. No specific social security scheme is proposed.

Who will be covered exactly? Establishments will have to be registered for the workers to be covered. The threshold number of workers will be decided by the government. What will be the threshold level? This BJP government has raised the threshold level of employment under the Factories Act to 40. That means that more than 72% of factory workers who were being covered by the Factories Act will now be thrown out. Will the factories with less than 40 workers be eligible for registration under the Code on Social Security? Will the workers of these establishments be eligible for whatever benefits are provided under this Code? No answer.

What is clear is that the government is not contributing a single paisa for social security for the workers. (Except of course spending some thousands of crores of rupees on advertisements, to secure its own future and to benefit the owners of corporate media) Unorganised workers will have to contribute at the rate of 12.5% of their wages for the social security benefits. If the employers are not identifiable, the workers are categorised as self employed and they have to contribute 20% of their earnings.

15 existing social security legislations –

• Employees State Insurance Act

• Employees Provident Fund and Miscellaneous Provisions Act, the

• Employees Compensation Act

• Maternity Benefits Act

• Payment of Gratuity Act

• Unorganised Workers Social Security Act

• Building and Other Construction Workers Welfare Cess Act

• Beedi Workers Welfare Cess Act

• Beedi Workers Welfare Fund Act

• Iron Ore Mines, Manganese Ore Mines and Chrome Ore Mines Labour Welfare Cess Act

• Iron Ore Mines, Manganese Ore Mines and Chrome Ore Mines Welfare Fund Act

• Mica Mines Labour Welfare Cess Act, the

• Limestone and Dolomite Mines Labour Welfare Fund Act

• Cine Workers Welfare Cess Act and

• Cine Workers Welfare Fund Act, - are amalgamated into this Code on Social Security.

The entire fund with the existing central funds like the EPF, ESI, CMPF, Building and Other Construction Workers’ Welfare Fund etc, amounting to around Rs 12 lakh crore, along with the huge amount that will be collected from the unorganised workers and self employed, will be placed at the disposal of the National Council of Social Security, to be chaired by the Prime Minister. This will then be made available for speculation in the share market to satisfy the finance capital lobby.

Is this social protection or blatant deception?

Remember, the erstwhile UPA government had enacted the Unorganised Workers’ Social Security Act in 2009. No new social security benefit had been formulated under that Act; neither during the tenure of the UPA government nor under the present BJP led Modi government. No funds were allotted for the social security schemes under this Act; either by the then UPA government or by the present BJP government. Only some already existing social security schemes, most of them meant for BPL people were made applicable to the unorganised workers. The present government made even the National Social Security Board constituted under the Act totally non functional. Some of the old schemes were discontinued and launched with new names.

Cutting down social welfare expenditure and pampering the big corporates, big business and finance capital – is the hallmark of neoliberal policies.

CITU and other central trade unions (except the BMS, which called the Code on Social Security ‘historic and revolutionary piece of legislation!) are determined to expose this fraud on the workers.

The mass dharna near Parliament on 9-11 November 2017 is part of this effort. We appeal to the workers irrespective of affiliations to be prepared for bigger struggles till we achieve universal social security for ALL.

We shall Fight! We shall Win!